Contents:

Deferred payments are payments which are made sometime in future. Debts are usually expressed in terms of the money of account. The use of money as the standard of deferred or delayed payments immensely simplifies borrowing and lending operations because money maintains a constant value through time.

But such a double coincidence is a rare possibility. Interest rate on bank loans is same as the interest rate charged by the traders. Promise to sell crops to traders at low prices as repayment of loan. Money as measure of value or a unit of account solves the barter problem of lack of common measure of value. Money measures exchange value of commodities and makes keeping of business accounts possible. Another Function ‘Liquidity of Money’ is added these days.

The demand deposits are a part of commercial banks and are used as a non-confidential fund. These accounts are considered money when included in the economy of a country. Such deposits’ working mechanism is similar to that of a checking account where withdrawals from the fund can be made without notice.

Possession of money enables one to get hold of almost any commodity in any place and money never locks a buyer. It is this peculiarity which distinguishes money from all other commodities. A preference for liquidity is preference for money. Wealth can be stored in terms of money for future. It serves as a store value of goods in liquid form.

Why Are Demand deposits Considered As Money?

And in case he doesn’t have any asset then loan can’t be provided by the bank. In this situation he will have to pay a visit to moneylender even if the latter charges are of high interest rate. On looking at nation’s development we find that it is cheap and affordable credit which is essential for development. So, it is necessary for any country to expand its formal sources of credit. Only keeps a very small amount of their deposits with them in form of cash so that they can pay to the depositors in case they wanted to withdraw the money at any point of time. At present, it is the rich households who receive formal credit whereas the poor have to depend on the informal sources.

However, caution must be exercised in the case of loans from the informal sector which include high interest rates that may be more harmful than good. Money supply has a major impact on the economy of a country. The inflation of prices of commodities, their demand, and supply change the supply of money.

However, the moneylenders charge very high rates of interest, keep no records of the transactions and harass the poor borrowers. Informal lenders like moneylenders know the borrower personally and hence, are often willing to give a loan without a collateral. Bank loans require proper documents and a collateral. Absence of collateral is one of the major reasons which prevents the poor from getting bank loans. If a person has to make a payment to his or her friend and writes a cheque for a specific amount, this means that the person instructs his bank to pay this amount to his friend.

What is term deposit and demand deposit?

Thus money facilitates the formation of capital markets and the work of financial intermediaries like Stock Exchange, Investment Trust and Banks. Money is the link which connects the values of today with those of the future. It has become possible because value of money is stable and it has general acceptability and durability. Normally, the bank pays a nominal amount of interest on deposits made through these accounts. A current account is a bank account in which you can retrieve cash for everyday use without notice.

Theory, EduRev gives you an ample number of questions to practice Why are demand deposits considered as money? Tests, examples and also practice Class 10 tests. How can the formal sector loans be made beneficial for poor farmers and workers?

What is meant by demand deposits Class 10?

In economics, money supply plays a role in the interest rates and cash flow prevalent throughout the country. M1 is the most narrow definition of the money supply. It includes coins and currency in circulation—in other words they are not held held by the U.S.

This is the main source of their income earning. Keeps major proportions of deposits to use in extending the area of loan provided. Money solves the issue in such a way that there is no need for the person to have the same thing the other one wants to buy. If a person has money then there is no matter to having the same required commodity or not. He can easily get exchanged the service or commodity.

The Demand Deposits are the deposits that are payable on-demand or on call. In other words, such deposits can be withdrawn by the depositor as and when required. Since demand deposits are always available on-demand, they are chequable deposits i.e. cheques can be issued against such deposits. Instant demand deposits offer higher liquidity and are a quick and highly effective source of money for individuals and businesses.

Money as medium of exchange solves the barter’s problem of lack of double coincidence of wants as money has facilitated separation of purchase from sale. You can sell goods for money to whoever wants it and with this money you can buy goods from whoever wants to sell them. People exchange goods and services through medium of money when they buy goods or sell products. Thus money acts as intermediary which solves barter’s problem of lack of double coincidence of wants. At very high rate of interest, say 15%, people convert their entire money holding into bonds indicating speculative demand for money to be zero.

Since demand drafts/cheques are widely accepted as a means of payment along with currency they constitute money in the modern economy. Demand deposits can be withdrawn on demand and can be used as a medium of exchange just like money. Payments in case of demand deposits can be made through cheque.

why are demand deposits considered as money class 10s and cooperatives should increase facility of providing loans so that dependence on informal sources of credit reduces. Describe the bad effects of informal sources of credit on borrowers. A person obtains credit to meet the working capital needs of production. How do demand deposits have the essential features of money? However, a country’s currency is said to have an inconvertible paper money standard if it is not convertible in gold or silver. Thus, it is conventional to describe a country’s monetary system in terms of its standard money, which serves as the primary source of supply.

An economy based on barter exchange (i.e., exchange of goods for goods) is called C.C. Economy, i.e., commodity for commodity exchange economy. In such an economy, a person gives his surplus goods and gets in return the goods he needs. For example, when a weaver gives cloth to the farmer in return for getting wheat from the farmer, this is called barter exchange. Similarly, the farmer can get other goods of his requirements like shoes, cow, plough, spade, etc. by giving his surplus wheat . Thus system of barter exchange fulfils to some extent the requirement of both the parties involved in exchange.

- Thus, the use of money as a measure of value is the basis of specialised production.

- A demand deposit helps you keep your money safe in bank accounts and provides quick cash for your personal and official needs.

- Demand deposits can be withdrawn by the user as and when the amount is required without any restrictions using cheques.

- Clearly money is the best form of store of value.

- Explain any three loan activities of banks in India.

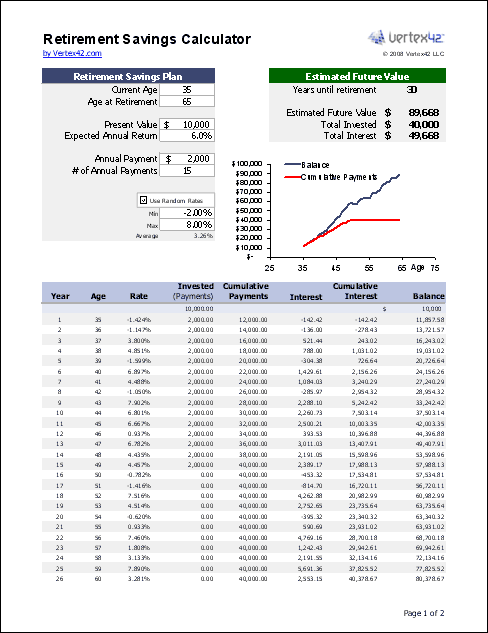

- The annual interest rate on the loan is 12% and the loan is to be repaid in 10 years in monthly instalments.

Helps to meet the working capital needs of production. “Focuses of currency have undergone several changes since early times.” Elucidate. Why do banks and cooperative societies need to lend more?

It is difficult for the people to store wealth or generalise purchasing power for future use in the form of goods like cattle, wheat, potatoes, etc. Holding of stocks of such goods involve costly storage and deterioration. Below accounts are used for other internal purposes and should not be used to transfer money to Upstox.

What is DEMAND DEPOSIT? What does DEMAND DEPOSIT mean? DEMAND DEPOSIT meaning & explanation

Saving accounts are used to meet daily on-demand requirements of cash. Demand deposits include savings and current account deposits because demand deposits are not for any specific period of time. Credit from the formal sector needs to be increased as loans from the informal sector, which have very high interest rates, do more harm than good.

Such deposits do not offer any rate of interest. Along with the currency, demand deposits are widely accepted as a means of payment. Why do rural borrowers depend on the informal sector for credit? What steps can be taken to encourage them to take loans from the formal sources? Demand deposits are considered as money, because they can be withdrawn when required and the money withdrawn can be used for making payments. So, they are also considered as money in the modern economy.

The formal sector still meets only about half of the total credit needs of the rural people. “The rich households are availing cheap credit from formal lenders whereas the poor households have to pay a heavy price for borrowing.” Comment. Describe the importance of formal sources of credit in the economic development. 85% of loans taken by the poor households in the urban areas are from informal sources. Informal lenders such as moneylenders, on the other hand, know the borrowers personally andhence are often willing to give a loan without collateral.

Here the autorickshaw driver can pledge his autorickshaw to the bank and the graduate student can pledge any capital asset owned by him. Banks charge a higher interest rate on loans than what they offer on ……………… . Other people in the village prefer to borrow from the moneylenders. Salim’s balance in his bank account increases and Prem’s balance decreases. Salim’s balance in his bank account decreases and Prem’s balance increases. Salim’s balance in his bank account increases, and Prem’s balance increases.

These two are the basic prerequisites for getting a loan from a bank. Formal sources of credit do not include employers as there is no role of these employers all these works are related to banks and the cooperatives. Employers are there merely to serve the bank staff and do the work as it is asked to do by their owner. Lal the major decisions are taken by the cooperatives, employers have to just follow those rules and regulations set up by the banks. Majority of the credit needs of the…….households are met from informal sources. Neither a farmer has any such asset to put as mortgage nor would any kind of documental procedure be done by them.

Form 497K Mutual Fund & Variable – StreetInsider.com

Form 497K Mutual Fund & Variable.

Posted: Thu, 04 May 2023 15:27:24 GMT [source]

They are widely https://1investing.in/ as a means of payment, along with the currency, thus they aqre considered as money. Every loan agreement specifies an interest rate which the borrower must pay to the lender along with the repayment of the principal amount. They can just discuss and then take decisions where majority agree. With the passage of time the bank submits the information regarding lending and interest rates etc. The higher cost of borrowing represents that a major proportion of the earning of the borrowers is used to repay the loans and due to which nothing has been left for their own. Few of them said that they borrow money from relatives and friends as there is low rate of interest required and sometimes no rate of interest as well.

Farmers usually take crop loans at the beginning of the season and repay the loan after harvest. Banks make use of the deposits to meet the loan requirements of the people. Explain any three loan activities of banks in India. Supervision by the Reserve Bank of India on the functioning of the formal sector.

BEIGENE, LTD. Management’s Discussion and Analysis of Financial … – Marketscreener.com

BEIGENE, LTD. Management’s Discussion and Analysis of Financial ….

Posted: Thu, 04 May 2023 11:19:07 GMT [source]

It should be mentioned that the adoption of a specific monetary standard in a country at a given moment is determined by the country’s economic conditions. It is important to note here that the money supply does not include the stock of money held by the government or the money under the possession of the banks. These institutions serve as the suppliers of money or are involved in the production of money rather than being a part of the money supply.